Advanced Trading Account

-

Advanced Trading Account / Mechanical trading systems

Algorithmstocktrade Trade has been sharing financial freedom with traders since 2014. In a continuous effort to give traders a more comfortable and safe experience, its experts have been improving the platform ensuring traders can enjoy and make use of that freedom to trade whenever and wherever they like.

Advanced Trading Account

-

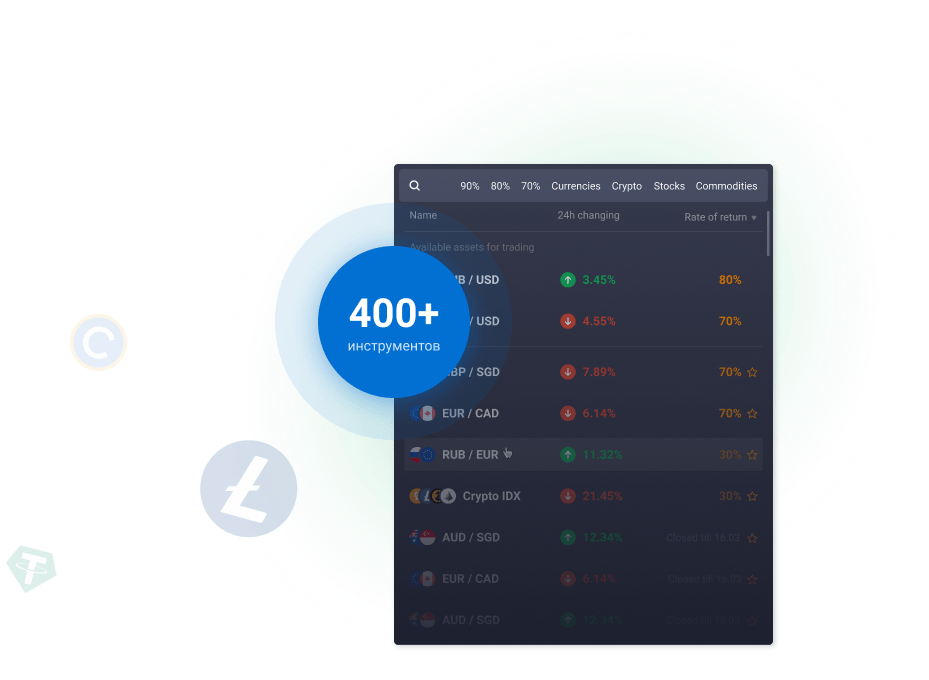

Advanced Trading Account also referred to as mechanical trading systems, algorithmic trading, automated trading or system trading - allow traders to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer. In fact, various platforms report 70% to 80% or more of shares traded on U.S. stock exchanges come from automatic trading systems.

Traders and investors can turn precise entry, exit, and money management rules into automated trading systems that allow computers to execute and monitor the trades. One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met.

The trade entry and exit rules can be based on simple conditions such as a moving average crossover or they can be complicated strategies that require a comprehensive understanding of the programming language specific to the user's trading platform. They can also be based on the expertise of a qualified programmer.

Advantages of Automated Systems

Minimizing Emotions

Automated trading systems minimize emotions throughout the trading process. By keeping emotions in check, traders typically have an easier time sticking to the plan. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. In addition to helping traders who are afraid to "pull the trigger," automated trading can curb those who are apt to overtrade - buying and selling at every perceived opportunity

Backtesting

Automated trading systems minimize emotions throughout the trading process. By keeping emotions in check, traders typically have an easier time sticking to the plan. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. In addition to helping traders who are afraid to "pull the trigger," automated trading can curb those who are apt to overtrade - buying and selling at every perceived opportunity

With the several withdrawals I have confirmed. I couldn't be happier with their service. Their team was professional, responsive, and the withdrawal process was smooth. I highly recommend pioneer Secure for their excellent financial services.

Katarzyna Szymańska Investor

Pioneer Secure has been my trusted partner on the journey to financial success. Their expert guidance and diverse investment options have helped me build a brighter financial tomorrow. invest with confidence

Francisco RibeiroInvestor

Lucy, hailing from the vibrant country of Canada. fwd from Luci: laxco's user-friendly platform made it easy for me to manage my investments, and their dedicated customer support team was always there to address my queries. Over time, I've watched my portfolio flourish, and it has opened up new opportunities for me and my family. I'm so happy for this achievement thank you so much.